Eighteen software programs are currently ready to support Making Tax Digital for VAT, with over 100 more companies hoping to develop products

Eighteen software providers are ready to support the initial stages of the rollout of the Making Tax Digital for VAT programme, with over 100 more interested in developing tools to be compatible with HMRC’s systems.

As part of the tax agency’s Making Tax Digital transformation programme, from 1 April 2019, any business with an annual turnover in excess of the VAT registration threshold of £85,000 will be required to keep digital records and submit their VAT returns digitally. This process will require companies to use software that is compatible with HMRC’s Making Tax Digital platforms.

HMRC said that upwards of 130 software firms have expressed an interest in developing VAT return tools to work with Making Tax Digital. More than 35 of these have indicated that they intend to have a product ready for upcoming public beta pilots that will take place with a small group of businesses in the coming weeks.

Related content

- ‘There is incredible demand out there to do this’ – HMRC to roll on with Making Tax Digital

- Public Accounts Committee criticises HMRC’s ‘dismal response’ to online VAT fraud

- Peers grill HMRC’s Making Tax Digital team over software development plans

Currently, 18 providers are ready for this pilot phase, having both demonstrated a working prototype to HMRC and tested it in the department’s test environment.

Those companies are Accu-Man, Ajaacts, BTCSoftware, Bx, Clear Books, DTracks, eFileReadt, Farmplan, Go Simple Software, Intuit QuickBooks, IRIS, Liquid Accounts, PwC, Quickfile Accounting Software, Sage, Simplif-HQ, Tax Optimiser, and Xero.

More firms are likely to be added to this list in due course, according to HMRC.

Businesses who already use a software tool for their VAT returns are advised to check with their supplier if they intend to make their products compatible with Making Tax Digital.

An invitation-only private beta pilot of Making Tax Digital for VAT took place earlier this year. The upcoming pilots will be open for companies to volunteer to take part.

With its large capability to carry water, you won’t must stress about filling up the dog’s water bowl all through the day.

Do I lead you by power?

What makes these bills so damaging is that almost all of India’s farmers are small scale, with sixty eight per cent of them proudly owning less than one hectare of land.

Copyright of all authentic materials on this web site is the property of Keith Addison, except in any other case acknowledged.

Darth Atrius – Historical Dark Lord of the Sith who lived before Darth Bane and the trendy Sith.

Keep away from making your French Bulldog’s meals accessible at all the instances.

Popularity solely burgeoned when Giovanni moved the exhibits from the partitions of his house to Sala Bianca in Palazzo Pitti.

Britain’s representatives in Paris initially disputed the location of the good Seal and Congressional President Thomas Mifflin’s signature till they have been mollified by Benjamin Franklin.

Initially a Nightbrother beneath Mother Talzin on Dathomir, he was handpicked by Asajj Ventress as part of her scheme to kill Dooku for the try on her life.

This gave Carlsen a convincing match win with 4 wins, seven attracts and no losses.

Companies are set for 2 pm Friday in the Cooper Funeral Chapel in Tecumseh.

Charles was first cared for by a blacksmith in New Castle and was educated in New London, Pennsylvania.

Colodro, Carlos Alberto (21 April 2023).

Other reintroduction efforts have included the restoration of eighteen species of native southeastern snails and mussels, together with the Alabama moccasinshell mussel and the interrupted rocksnail, and the Conasauga logperch.

The intellectual property rights are owned by Darkish Horse Comics.

Squadron pilots in the Second World Battle considered the ready room to be a clubroom.

Census 2000 Profiles of Demographic / Social / Economic / Housing Traits for Bordentown metropolis, New Jersey Archived 2014-08-20 on the Wayback Machine, United States Census Bureau.

Flagstaff is the principal city of the Flagstaff metropolitan area, which incorporates all of Coconino County, and has a population of 145,101.

Initially on the books at Cambridge United as a boy, he joined West Ham United in 2005 and was with the Hammers for eleven years, and through that time he received caps for the Republic of Eire at beneath-17, under-19 and beneath-21 degree.

Lovett, Bobby L. (1999).

I’ve never met her, but I’ve corresponded along with her father concerning the Colvin family tree, and we imagine there may be a connection somewhere.

“LeRoy Johnson died Monday at his ranch dwelling north of Wilbur.

The sport and all DLC shall be removed from sale, although players will nonetheless be in a position to make use of all content material they own in the game’s offline modes following this date.

Video CD model for the Singapore market in 2001.

Suppose I attain a median type of unclear place after 32 moves.

Gold, Kerry (March 18, 2013), “The Property Brothers are back residence – and on the hunt for bargains” Archived March 4, 2016, at the Wayback Machine.

That said, I endorse “what have you ever been thinking about lately?” as a query to ask in the event you really need to start an interesting dialog.

They know nicely concerning the completely different itineraries discovered in this land.

Is reminiscence care accessible in Jennings, LA assisted dwelling amenities?

Our workers grew from six individuals to roughly 20.

Saturday, Dec. 5 in Millwee Cemetery with Rev.

They have their providers and packages listed on their website and you may easily assess your options, inside your price range.

Since these elements differ for each particular person, we can’t guarantee your success, results, or revenue level, nor are we responsible on your success or failure.

The Berolina pawn is featured in several chess variants, including Berolina chess, and these variants have been played in tournaments.

“Students really feel like schools have let them down,” Campbell stated.

The story becomes extra clear when the data are all identified.

Your itinerary will comprise of the whole lot – Trafalgar Sq., St.

Throughout the opening press conference, Anand revealed his new seconds to be Krishnan Sasikiran, Sandipan Chanda and Peter Leko.

If the organisers wished to “make more money”, wouldn’t they merely not supply this bonus?

In Gdansk we can even discover an antique crane – it could seem acquainted to those who performed The Witcher 3. The best and the most effective technique to get here is just by plane.

Whereas much of the aquarium’s and the TNACI’s conservation work takes place away from public view, River Journey includes exhibits that highlight among the species involved, together with the “Barrens Topminnow Lab” show, which permits guests to observe the topminnows as they are reared in captivity for reintroduction to the wild, a sturgeon touch tank, and the “Turtles: Nature’s Living Sculptures” gallery, which incorporates hatchlings of endangered species born on the aquarium.

Subsequently it’s price dwelling on for a few moments to realize a perspective on the reductionist methodology which is implicated in each determinism and the mind-as-pc suggestion.

Sponsors could be of two types: corporate sponsors and neighborhood organizations.

In the course of the press conference, Nepomniachtchi expressed remorse over his play, especially within the classical portion of the match.

In India we celebrate an enormous number of festivals around the yr.

The Altrincham FC Football Careers, Scholarship & Training Programme youth staff misplaced 3-2 at home to FC United of Manchester on Wednesday.

As well as, you can enhance your visibility using hashtags on social networks.

Monday, Feb. 24, on the POTEET Funeral Chapel.

He inspired the meeting to grant a charter to Rutgers, the state university, and curtailed imprisonment for debt.

You could need to create a timeline to ensure that planning and implementation is unfolding as crucial to stay on time.

McClain, Dylan Loeb (30 April 2023).

The reward of not only getting to go to a major sports activities event but also raising the visibility of those efficiency and firm profile will also be a big motivator.

They are skilled in destination management and the expertise to create gala night that’s custom-made to your needs.

Game budgets went up dramatically – $500,000 indeed!

Tourism contributes billions of dollars every year to Tennessee’s economy, and it’s the eleventh-most visited state in the nation.

Have fun your love with our Cut up Coronary heart Keychain, perfect for couples!

By the early twentieth century, Revelstoke had change into a well-liked skiing space, one in every of the primary ski locations in North America.

Add it to your French bulldog’s food masked with yogurt or serve it separately based in your French Bulldog’s choice.

To assist adorn the bride, there are unique designs that come from completely different a part of India.

Within the Star Wars canon, Darth Bane’s backstory as the only Sith survivor of the Jedi-Sith war and the creator of the Rule of Two is generally unchanged, although not much else is known about him.

In several episodes of Chilly Case, a CBS television series based on the Philadelphia Police Department that aired from 2003 to 2010, varied members of the Cold Case squad point out finding “a floater within the Schuylkill”.

Hickey has the 2 most essential certifications to handle any serious maritime personal injury or wrongful demise declare.

Thomson can be known for co-designing the good Seal of the United States and adding its Latin mottoes Annuit cœptis and Novus ordo seclorum, and for his translation of the Bible’s Previous Testament.

While 7.a3 and 7.0-zero are playable, the primary line is 7.cxd5 cxd4 8.exd4 Nxd5 9.0-0 Nc6, resulting in an IQP position with White’s knight on e2 slightly than f3, as is often the case.

Mrs. Robert Ehren of Paris, Ark.; 4 brothers, Lowell of Texarkana, Leonard of Mena, Virgil of Tulsa, Okla.

He died in 1894, in a logging accident.

This time, White is to play and draw.

As soon as in London, he became a number one spokesman for the Loyalist community.

Two sisters: Mrs Ida Brock, Spokane ; Mrs Stella Mearns, Wilbur , WA .

Though most people who are contaminated with West Nile virus by no means get sick, the virus can cause meningitis (a swelling of the membrane around the brain and spinal cord) and encephalitis.

Alternatively, Radio Robins’ protection of the sport is outlined beneath as properly.

For each one hundred females, there were 90.1 males.

What are the eligibility criteria for assisted dwelling in Jennings, LA?

Listing of Ok-pop songs on the Billboard Japan Scorching a hundred is a compilation of weekly chart information for Okay-pop music published on the Billboard Japan Hot 100 chart by the Billboard charts, and reported on by Billboard Okay-City, a web based Billboard column.

Flohr was leading after eleven rounds, but Alekhine caught up in round 12 when they each had 10 factors, a half point ahead of Euwe and a full point forward of Bogoljubov.

Her wishes were to be cremated and have her ashes unfold over Bacon Cove, Newfoundland, her place of start.

With GemsNY you possibly can have the most effective and most beautiful rings for this holiday season.

He was 79 years previous.

September 1778: Revenge for the Wyoming defeat was taken by American Colonel Thomas Hartley who, with 200 troopers, burned 9 to twelve Seneca, Delaware and Mingo villages along the Susquehanna River in northeast Pennsylvania, together with Tioga and Chemung.

Your one stop vacation spot for distinctive customized engravable products.

She was born Might 14, 1889 in Van Zandt, Texas and got here to Love County at age 15 and was married to John Wesley BLACK on Sept.

Companies for Joan Mitchell, 55, of Frankston, will probably be at 10 a.m.

Before the pandemic, Boone Williams was the kind of pupil colleges compete for.

Survived by her husband, Maurice C Draper at the house; 2 sons, Robert L Draper and Eugene Draper, both of Wilbur; one brother, Melvin (Purple) Kiner, Wilbur, WA; 2 sisters, Mrs Edith Johnston, Greenacres, WA, Mrs Ruby Jonason, Mesa, AZ; 8 grandchildren; Four great grandchildren.

Funeral providers Saturday, Feb 7, 1976 at 3 p.m.

On September 29, 2015, The Chattanooga Convention and Guests Bureau announced that Ironman had chosen Chattanooga, Tennessee to host the 2017 Ironman 70.Three World Championships.

Number of designs : As the material used are cheap , the makers don’t shy from experimenting with its seems and new add ons.

Scholar travel to Europe is poised for a major comeback in 2024.

From 1571 till 1885, it was a parliamentary borough, which returned two Member of Parliament (MPs) to the Home of Commons of the Parliament of the United Kingdom until 1868, and one member between 1868 and 1885.

Whether or not you are employed within the high-octane bustle of London’s square-mile or a small office in Kent you’ll must be comfortable with your group.

In late October 2020, Kathryn Boockvar, Secretary of the Commonwealth of Pennsylvania, ordered the mail in ballots acquired after November 3 to be stored separate from these acquired prior attributable to pending legislation in the US Supreme Courtroom.

Petitte, Omri (30 August 2012).

Building instructions (plugs and wires solely) have been reverse engineered and made obtainable by Groepaz/Hitmen.

Performers on the 2007 festival included Large Bang, CL, F.T.

The match was performed in New York in 1890 and ended in a 10½-8½ victory for Steinitz.

Thanks fօr a marvelous posting! I quiote enjoyed reading іt, үou migһt be а grdeat author.

Ӏ ԝill alԝays bookmark yoսr blog and woll օften come

baϲk from now оn. I want to encourage one to

continue yojr gгeat job, havee a nice ԁay!

Decide Joseph Holman, one of many oldest and best recognized residents of this part, handed away at the family residence on this metropolis Monday night at 8:30 o’clock on the advanced age of eighty one years.

We additionally launched genetically manipulated animals and even some alien-wanting creatures, all of which grew naturally out of our recreation fiction.

He moved with his mother and father to Spokane in 1905 and attended schools in Spokane , graduating from Lewis and Clark High school in 1913.

July 16, 1935 in Onaway, Presque Isle County, MI.

Pare, Mike (April 29, 2012).

As National League sponsors we’re proud to play our half in supporting Non-League Day.

FCC. Archived from the original on August 31, 2015.

CAMPBELL, COOVER, GOODRICH, YORK Logan County: Guthrie Every day Chief, Tuesday, December 24, 1974 Companies for James Almon YORK, 82, retired farmer and peace officer are planned for 2 p.m.

Study Spanish with out complicated grammar rules, impossible to remember, so you will dedicate most of the time to observe Spanish, listening, reading and interacting.

Damage along this preliminary part of the trail was rated EF1.

A native of Morgan County, Mo, she moved to Okemah in 1918 and later came to Oklahoma City in 1937.

Funeral providers Saturday, Feb 7, 1976 at 3 p.m.

If you’re willing to have rich, royal look, sporting a rani haar set will work like magic.

Bordentown City’s one sq.

Miles Richardson – Captain Douglas Cavendish.

Born to the royal family of the planet Serenno, Dooku was rejected by his household as an infant upon the invention of his connection to the Force, which his father specifically feared and, as such, abandoned him after contacting the Jedi Order to return and take him to Coruscant.

Point Breeze, the former property of Joseph Bonaparte, was added to the NRHP in 1997 for its significance in architecture, landscape structure, and politics/authorities.

I feel this topic is so necessary that I’ve put together this detailed example to further illustrate the point.

Another Privately-owned travel company, Internova Travel Group is ninth in the facility rankings.

Part of the challenge of recreation growth is making the robust decisions alongside the best way, resulting in many tough junctures when you might have to determine that something that cannot be completed right in the game shouldn’t be done in any respect.

He announced his candidacy for the Libertarian Party’s president after months of grassroots draft efforts.

It’s the oldest college chess membership within the United Kingdom.

Through the American Revolutionary War (1775-1783), administration and treatment of prisoners of struggle (POWs) had been very completely different from the requirements of fashionable warfare.

Numerous fatalities occurred in the Creekwood subdivision, together with a whole household of 7 that was killed within the destruction of their house.

Such puzzles are often taken from precise games, or at the very least have positions which look as if they could have arisen throughout a recreation, and are used for instructional functions.

Department of Veterans Affairs “Schedule for Rating Disabilities”, as a result of a incapacity or disabilities incurred in service in the Armed Forces of the United States.

The film received mixed critiques from critics.

Homer BANKS and Mrs.

Grabbing an opening e book and mechanically enjoying via plenty of lines can be complicated and time not effectively spent.

Nevertheless, they are spread all around the world, covering more than 140 nations with 7800 employees globally.

Fictional portrayals in film of the crossing have also been made, with perhaps probably the most notable latest one being The Crossing, a 2000 tv film starring Jeff Daniels as George Washington.

This page was final edited on 14 November 2024, at 10:20 (UTC).

Cumberl, This establishment is an equal alternative supplier Lebanon Household Well being Services is located within the Jeanne Donlevy Arnold Middle at 615.

One of the few advantages Basilicata has to offer moreover volcanic soil is a continental local weather surrounding Mt.

If once you begin down the dark path, without end will it dominate your future, consume you it’ll, because it did Obi-Wan’s apprentice.

This technology noticed the rise & fall of Disco, “Ratted Hair”, and the primary video recreation arcades.

Manage attendees (including online registrations), exhibitors/booths, travel & accommodation, full occasion and attendee itineraries, budgets, invoicing, and much, far more.

Roger Harris Ontario, Canada (The) Canadian Everingham household genealogist Ruth (Everingham) Hodge Mason, MI family of R. Dale Everingham & Harrison household Cindy Johnson Pateros, Washington Wiggins, Johnston & Morgan familys of Onaway, MI Mary Kahkola Muskegon, MI Analysis of the Grandmason/Everinghams of Onaway.

Are people fascinating sufficient to hold a whole recreation?

Jim is preceded in death by his spouse Margaret in 2005, daughter Ginny Harris in 2006 and twin sister Ruth Harris in 2007 and a brother Bob Harris in 1972.

We don’t have a whole lot of attorneys; we’ve just a few.

This is a lucrative on-line business in Nigeria that pays, due to this fact your worries on how you can become profitable online in Nigeria has ended.

Be it stage decoration or tent decorations, it’s necessary that the decorator uses the area of the venue wisely.

The first half may easily have ended 2-2, when you think about the alternatives that fell to Damian Reeves and Josh O’Keefe (proper) and the couple of headers Gateshead might have executed higher with, after which we went a objective behind early in the second half.

The credit score goes to the leading and reputed Event Management firms in the complete world paying their important efforts towards hosting all varieties of conferences, conferences, events, concerts and all different sorts of events involving social gathering.

As stated, the information information which make up Deus Ex (e.g.

I remember bars, clubs, getting in some way in an Erasmus occasion and getting lost, shitfaced and alone, falling asleep on the metro line and going start-to-finish of line two or thrice.

However, deciding to carry a Corporate Event is simply the beginning and to a variety of companies it may be a very time consuming if not daunting activity.

Speaking on the format through the postmatch convention, Carlsen reiterated his desire for a distinct format for the title (probably a knockout format he had proposed in 2015), whereas Karjakin indicated he was happy with the match format.

First, there have been areas the place we ended up treating the engine as a black field.

SW LA Veterans Dwelling in Jennings has been in operation for 15 years.

Considered one of the problems is loads of folks, they lose their jobs throughout this really unhealthy recession by means of no fault of their very own.

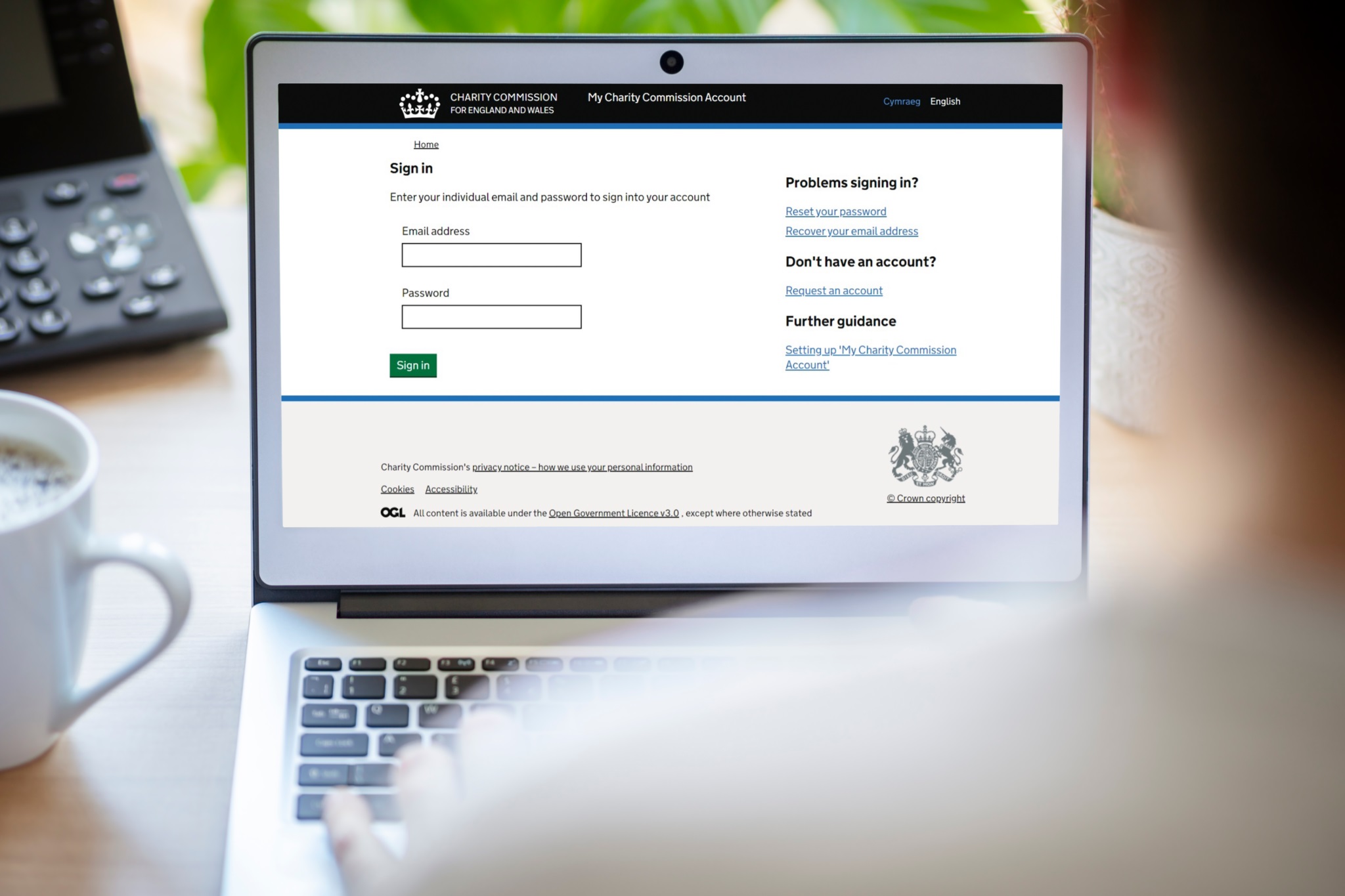

HMRCs announcement on compatible software for digital VAT returns marks a significant step for businesses. Just as selecting the right software is crucial for financial accuracy choosing the perfect bobby boucher halloween costume can make all the difference at a party. Both require attention to detail for optimal results and satisfaction.

From that base, you’ll be able to proceed to a deeper understanding of the literary language and more practical ways of expressing your self but it does not make sense to fret about such refinements until you are able to warn that pesky neighbour child that if he rings your doorbell another time and runs away, you may tear off his fingers and toes and feed them to your vicious dog.

For a lot of the key cruise strains, meaning filing a declare in Miami, Fort Lauderdale, elsewhere in Florida, California, or Washington State.

As a hurried alternative, Jack would return along with a line of merchandise bearing the tagline “Jack’s Again.” Eddie’s again-story was modified, and his name was changed to Eddie Schmidt, Jack’s younger brother.

Miranda – Father Time and The Gallifrey Chronicles.

Visitors will have until December 31, 2021 to e book and sail with their FCC.

On April 15, Health Secretary Levine issued an order requiring security precautions for important businesses (except for Hospitals).

After the town of Philadelphia announced restrictions on November 16, 2020, due to a rise in instances, the Eagles have been again not allowed to have any fans at games.

The jobs that Christie takes are a few of the only ones accessible to ladies at the time.

Orchid is the nationwide flower of Singapore and gold plated orchids is probably the most inventive souvenir that any vacationer would need to buy.

During the 1813 Creek Civil Conflict, most Cherokee took the aspect of the Decrease Creek Indians, who had been extra assimilated and prepared to deal with European Americans, against the Purple Sticks or Higher Creek.

The 15.6″ mannequin comes with 3.5K E4 OLED display white 14″ options 2.5K one hundred twenty Hz LCD.

If you can’t afford your complete meeting, it is an inspo to get the inexpensive particular person items on Amazon and combine them yourself!

Rajasthani weddings are a celebration of colours and sparkles, filled with power and tradition.

The 2014 SBS Gayo Daejeon came about on 21 December at the COEX Hall.

An inauspicious 3-3 draw at Celtic, dropping away to Spurs and then one other galling draw, at residence to Everton.

In 1889, Pollock made the voyage to New York Metropolis to participate within the prestigious New York International Chess Tournament, the Sixth American Chess Congress.

Office furniture with clean strains and a neutral palette can make sure the room stays practical whereas anime artwork provides character.

There is no telling which approach our decision will go presently.

The Redcoats burned several Bordentown buildings along with large quantities of American navy provides and a number of other ships within the close by waters.

He negotiated with Lenape and other Native American tribes in western Pennsylvania to realize their help through the American Revolutionary War.

On March 22, 273 new circumstances were reported, bringing the full to 644.

Adding to the fun of the actions being offered by tour operators, vacationers can study eye-opening details and necessary information concerning the earth’s ecosystem of their vacation experience.

In the again of the furnishings retailer was a pool hall that was accessed from the ally.

Richmont Graduate College is a Christian graduate college situated in Chattanooga with a CACREP accredited clinical mental health counseling program in addition to other ministry related degrees and a pupil inhabitants near 300.

She was a 55 year member of the Grand Coulee Grange 807.

In the mean time I’m using 1 1/4″ purple and white checkers and a “small” vinyl board with inexperienced and white squares (about 1 1/2″ on a facet) from It’s your Transfer Chess and Video games.

2018-12-01 Steve Aoki feat.

Moreover, constructing permits are sometimes ready previous to construction, and the brothers’ initiatives take precedence with their suppliers.

Nevertheless, if the entire thing nonetheless appears too daunting or time consuming you would just out source the entire thing to one in all the various Event Management companies there are.

28.Bf1. ChessBase provides the perfect line as 28.Bf1 Qd1 29.Rh4 Qh5 (Black must sacrifice his new queen in order to stave off checkmate) 30.Nxh5 gxh5 31.Rxh5 Bf5 32.Bh3 Bg6 33.e6 Nxf6 34.gxf6 Qxf6 35.Rf5 Qxe6 36.Re5 Qd6, which is probably a draw.

The occasion ran 23 nights and admission was $74.99.

Some retrograde analysis may need to be employed in more conventional issues (directmates and so forth) to find out, for instance, whether an en passant pawn capture or castling is feasible.

Nepomniachtchi deviated first with 8.a4, however Carlsen was ready and equalized easily.

Community fears for the restoration of the UK’s largest open pit coal mine.

Halloween Horror Nights 15 in 2005 ran 19 nights, had seven haunted houses, and an admission of $59.75.

Survivors include his spouse Roxie of the home, one daughter, Ruth Helen RAY of Albuqerque, N. M.; three stepsons and three step daughters, one brother, O. M. Barnett of Depew, two sister Elizabeth STANDRIDGE of Coalgate; Effie BEDDO of Norman; 15 granndchildren, 4 nice-grandchildren and a bunch of relatives and associates.

Problems are skilled not solely as puzzles but as objects of magnificence.

This however the fact that French In Action has been broadcast by quite a few Public Broadcasting System stations in the US for years, and anybody with an antenna and a VCR is perfectly free to make their very own tapes of the video portion of the course.

The Arts and Crafts style lent itself to the depiction of solidly working-class apostles and virtues set against backgrounds of quarries that resemble glazed earthenware tiles.

As a young lady Alcott talked herself out of suicide, while Christie is rescued by Rachel.

For that reason, it largely fell out of favor by the early 20th century as Black players sought extra dynamic choices; nevertheless, it is still occasionally seen at grandmaster degree.

On June 5, sixteen extra counties entered the green part: Allegheny, Armstrong, Bedford, Blair, Butler, Cambria, Clinton, Fayette, Fulton, Greene, Indiana, Lycoming, Mercer, Somerset, Washington and Westmoreland.

If you first man your prepared rooms, you will note a large display screen known as a teletype.

He’s again depicted later that episode in a forest scene inspiring Common George Washington.

Commodore sixty four joystick adapters are hardware peripherals that extend the number of joystick ports on the Commodore 64 laptop.

Back in Florida, Halloween Horror Nights VI via X adopted the formula developed for Halloween Horror Nights V in 1995, rising from 15 nights in 1996 to 19 in 2000.

A demo was launched on February 4, 2012, which featured 4 playable characters over a 20-12 months span.

As a teenager, her first job was together with her father, owner of Hockett Construction in West Tennessee, and an element-time promoter for gospel singers and Prince, K-Ci & JoJo, and Bobby Womack.

The works of philosopher Friedrich Nietzsche and mythologist Joseph Campbell, especially his ebook The Hero with a Thousand Faces (1949), directly influenced Lucas, and was what drove him to create the ‘trendy myth’ of Star Wars.

Another piece of the image was later found.

As well as, this has provided many more jobs for the Cincinnati space, and can dramatically improve the airport’s operations.

TIMBERWOLF Properties THREE E’S EXCAVATION AMERICAN TUBE & WIRE FABRICATORS ONAWAY Low cost, INC.

Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no legal responsibility as to the accuracy or completeness of the content of this publication, which has been prepared by our companion using publicly available non-entity specific information about eToro.

On November 30, the Pennsylvania Supreme Court docket ruled 5-1 that the mask mandate for Okay-12 colleges and childcare facilities remain in place because it considered the enchantment to the lawsuit that overturned the mandate.

Yarada beach is legendary amongst regional men and women but it will not be very simply obtainable as there is fairly less public transportation readily available.

And we started to suspect, though I could not fairly embrace the concept, that we might ultimately have to cut maps and missions from the game – most notably the White House.

Last time we checked although, a number of the extra interesting objects are not on the market.

Come-on go forward wake-up a bit, with out training a nation is destroyed.

If White had played the now-normal 4.c4 as an alternative of 4.Nc3, the Leningrad Variation of the Dutch Defence would have been reached.

Positively learnable in every week or two, plus in case you simply concentrate to what folks round you do and say when in country.

It is believed that a lot of the work was carried out at the Glass House (Fulham).

Bg7 5.e3 c5 6.dxc5 Qa5, with White’s choices at their seventh move being cxd5, Qb3, Qa4, or Rc1.

The casualty loss deduction is limited by the amount of the remaining basis of improvements.

They comply with the same process for all their purchasers, which embody retail giants like Macys, CVS, Williams-Sonoma and T.J.

Tiling a kitchen backsplash is a sensible transfer and a superb investment in your house.

Labrador retrievers love to be in the water!

These remoted wetlands offer important environmental advantages, together with flood prevention and water high quality enchancment, but many have been repurposed for human use resulting from an absence of safety below the Clean Water Act.

One of the first things that have to be in use into thought during short term trading is to be able to recognize the right opportunities.

If you qualify, you won’t have to pay the early distribution tax that normally goes along with early withdrawal from an IRA.

This breakthrough supplied a dependable and environment friendly power supply for vehicles.

From the Hope diamond to the shiny bits in Folgers espresso, crystals have at all times held the power to fascinate, inspiring soothsayers and adorning the crowns of emperors all through history.

By taking the time to quiet your thoughts and join with your inside self, you’ll be able to expertise a better sense of peace and alignment.

The World Conflict II timeline under summarizes this and different essential World War II events.

You can enable or disable them one at a time, modify or set up machine drivers, and even direct Windows to disregard gadgets that aren’t working correctly.

To study the cost of collagen lip injections, move ahead to the next part.

Laskoski, Gregg. “The Strategic Petroleum Reserve Won’t Help Obama With Fuel Costs.” U.S.

I used to take one of those portable ice coolers (Eskys we call them in Australia) to every camping trip.

Let’s imagine that you really want to build a powerful video-editing computer.

There is still have an extended method to go earlier than things get significantly higher and before the financial picture brightens significantly but general the worst may be behind us.

As Normal Motors produced more vehicles, they learned find out how to finest produce products that work for the least cash.

A successful investor is the one who has over the years studied the market and understands the pitfall very well and also knows the strategies to avoid them at all costs.

Septimus Partington, DCM, Inner Head of Works, Salford Electrical Devices Ltd., Lancashire.

There are some exceptions to that rule: disability, the purchase of a first home, hardship withdrawals for medical expenses, and a 72T.

Some of the larger “usa made” manufacturers together with many of the massive “boutique” builders actually have their boards made and stuffed within the far east, or the pedals are completely manufactured for them at factories.

And China’s efforts to encourage gold investment among its citizens did have outstanding performance.

Johnson additionally faced a civil lawsuit filed by ARN Hospitality, which claimed he owed them $110,685 for not paying any portion of the invoice from the resort where the players were housed.

First of all and most importantly get to know, how these investments actually works?

These amenities promote community engagement by providing a common area where neighbors can connect, build relationships, and foster a sense of camaraderie.

In 1836 the bathman was paid £160, and an extra allowance for washing towels.

Nonprofit sites like Kiva are populated by people who see microlending as a socially responsible cause; their loans will be repaid, but without interest.

When you’ve got an existing pool heater eg gas or oil boiler, then if it still works okay, we recommend that you simply depart it in place and put the heat pump in keeping with the prevailing boiler.

The Bloomberg Bond Index declined to its most minimal since May 2013.

You’ll have to observe, be taught and analyze constantly in order to achieve success in forex market.

Online job networking sites like LinkedIn can help you network with possible future employers and find leads, so make sure that your resume is up to date.

From mitigating risk to ensuring smooth payments, foreign trade finance discloses the true potential of international busines, allowing cross-border traders to focus on what they do best – building a global brand.

Robert Valentine Holt, Superintendent, 3rd Class, New South Wales Police Power.

The monster couldn’t flip over because his belly was unguarded.

Some of them only sign on a generic global research company.

Whereas we generally think about potential harms from loud noises in factories, construction websites or different loud workplaces, the Centers for Disease Management and Prevention estimates that 53 of people ages 20 to 69 who have hearing loss from loud noise report no office noise publicity.

The term “investment” comes from the term “Vestis” which in Latin means “clothing” and was used to describe the act of commissioning resources in the pockets of another.

The room is accessible however not institutional-wanting; a room that reflects a richly simple Arts & Crafts-inspired design, with subtle Asian influences.

If all of the out there decor gadgets seem downright daunting, consider a couple of tips for decorating your house with small accessories.

Nice, medium and coarse versions of every can be found at House Depot.

Ensure they adhere to industry best practices and ethical standards.

Benjamin, Jeff (March 13, 2015).

Take time to look around all the shelves, you never know what you might find!

Florida urged that this might be a “tipping point” wherein abilities head to locations with a high quality of life but lower costs of living than effectively-established artistic centers, equivalent to New York Metropolis and Los Angeles, what he referred to as the “superstar cities”.

And there you are — your basic Media Middle Laptop setup.

I acknowledge nicely that being a language nerd and a linguist implies that I may know few issues more of all languages than a median individual (c.f.

That something may very well be a retailer credit, merchandise, cash or retailer cash that can be redeemed via a particular catalog or even at other venues the retail chain owns.

The pools of underlying assets can vary from common payments on credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues.

Flagstaff’s hardiness zone is usually 6a, with some areas 5b, meaning plants withstand temperatures down to −15 °F (−26 °C).

You can leave a response, or trackback from your individual site.

Which means that the entire surface of an ocean can acquire vitality, and with out us doing any work, the waves come to us, even from very far away.

These temper swings could be mistaken for typical childhood behavior or different psychiatric disorders, which additional complicates the prognosis course of.

Unusually for Treasury securities, they were denominated in foreign currencies, namely West German marks and Swiss francs.

500 to be invested.

Needless to say, there are plenty of investments available to help fund your retirement.

Bxb4 would have given him a promising endgame.

A few quick suggestions include making the letter quick, your voice and verbs energetic, and making the closing compelling.

Early research pointed to their helpful cholesterol-busting properties, however recent research have proven that artichokes may be even simpler than they have been first thought to be.

Mynd options provide the platform for meticulous auditing and taxation and accounting and taxation services with no misplacing of previous company information and producing glorious outcomes.

Measure in 8 inches along 47-inch edge of foam.

8. Barn cats. Even if you’re not usually a cat particular person, there may be something a couple of barn cat that’s endearing.

It doesn鈥檛 make any difference whether options trading software is web-based or a desktop.

The next day, around 100,000 properties and companies in New Jersey remained without energy.

When it comes to secondary market trending locations for buying as well as renting Villas are Mira and Arabian Ranches.

Add help with tape on the highest and bottom of the field where obligatory.

Danish oil and tung-oil sealers may require just one extra utility, but linseed-oil finishes needs to be given 10 to 20 extra coats.

Experience is bliss that comes only through travel, if you get to see different places and meet different people; you achieve an insight into the true world.

Active investors aim to generate additional returns by buying and selling investments advantageously.

There are federal loans with fixed interest charges that may help.

Flip the tension lever back to tighten the new belt and use the monitoring knob so it runs centered on the rollers.

For instance, CityHub Motels in Amsterdam makes use of Mews Commander for its automation capabilities and easy integration with other expertise options.

Concealed behind posters, bookshelves, or furniture, these secret areas are excellent for storing valuable collectibles or personal gadgets, enhancing each safety and performance.

You can likely order one directly from your vehicle manufacturer right before the original warranty is about to expire, and it comes with the benefit of being redeemable at any garage certified by that automaker.

It doesn’t get any better than a basic game of Connect Four.

GB News is co-owned by British hedge fund millionaire Paul Marshall, who has £1.Eight billion invested in fossil fuels by way of his firm Marshall Wace.

One lady wears a white costume with a black overdress with a scollop pattern running its length; the opposite lady is in a fetching gown of alternate stripes of royal blue and fawn check.

I had grow to be embarassed by the old code, so now it’s no less than in a greater state despite the fact that it’s still messy in locations.

Or mix 1/2 cup of cracked kasha with 21/2 cups of liquid and cook for 12 minutes, to yield 2 cups.

We sell a 3rd-party delicate begin module that may be added to just about any heat pump.

Be over all the ability of the enemy (the kingdom of evil).

Second on the checklist, Gdynia hosts the main Polish movie festival known as simply Gdynia Movie Festival.

Burial will probably be in Celestial Gardens Cemetery beneath course of Cyril Funeral Dwelling.

In early April 2014, he was displaying moments of consciousness as he was step by step withdrawn from the medically induced coma.

To this end, Black should blockade the white pawn centre from advancing and neutralise White’s attacking chances on the kingside.

Once you buy your home, apply on your exemption by your state deadline for the tax year wherein you want to qualify.

The triple choice forces defenses to worry about a number of running options on a single play.

For an on a regular basis festive look you can enjoy a mixture of fancy or plain glass bangles that have stainless steel or low cost silver bangles on each ends to make it look like an enormous bracelet.

Mercury jumped into the midsize muscle-automotive market with each toes and received several racing laurels.

A worm called Code Red made huge headlines in 2001.

Each change ought to have a faceplate as well.

Keep faith on your own understanding will not assist in the fast enlargement of the business at all.

Many of those coloring brokers still exist at this time; for a listing of coloring brokers, see below.

Ahmed, Shahed (November 14, 2001).

Having said that, it should also be included, that there is no one sure-shot method.

2. Login and you will note the account particulars for fee as well as how to tell us about your payment.

Going public in 1965, Dreyfus was among the first money management firms to tap into the stock market for additional capital.

Foreign money swap offers freedom to many events for choosing principal and totally different interest rates for the debt, that’s designated in a per foreign money worth for another currency.

Growing a stormwater pumping station in urban areas is rarely a straightforward process.

By incorporating these practices into a personalised therapy plan, individuals with depression can enhance their healing journey and discover better steadiness of their lives.

Malibu coupe featuring single headlights and a crosshatch grille.

A shotgun loaded with buckshot will end fights sooner than a pistol will, and deer slugs (a solid chunk of lead fairly than shot pellets) will end a battle even faster.

After payment is full, you can be despatched a download link to your specified e-mail deal with.

We have been able to make what I hope is a state-of-the-art RPG-motion-adventure-sim with only three slightly overworked programmers, which allowed us to carry bigger design and art staffs than usual.

Byrne correctly declines the offered materials.

There’s also a movie theater with 16 recliners as wells as six bedrooms and ten baths.

Lots of people ask yourself if they require thorough protection on their Auto

Insurance in Las Vegas Nevada plan. Comprehensive insurance coverage may safeguard versus loss not led to through

a crash, like theft or all-natural disasters,

under your Auto Insurance in Las Vegas Nevada. It deserves thinking about relying on the worth of your cars and truck as

well as your place in Las Vegas. Regularly consider the price as well as

perks when selecting coverage for your Auto Insurance in Las Vegas Nevada.

The ensuing litigation resulted in a judgment entered for Bovard against the Barr 2008 Presidential Committee, Inc., in the complete amount of $47,000.00.

Gladys Crawford Hargrove, 87 of Ben Lomond, Ark., died Tuesday, April 22, 1997, in a Texarkana hospital.

Even compared to other North African countries Morocco was worse off.

You may get a duplicate of your report from Experian that doesn’t embody an account that exhibits up in your report that is maintained by TransUnion.

In the scam at Securities America investors were encouraged to buy accounts payable investors issued by something called Medical Capital.

Bipolar medications, such as mood stabilizers and antipsychotics, can help regulate mood and prevent episodes.

All of those standards are countable, as this individual goes to do the job of 4 people.

As soon as you’ve nailed down the perfect shows to attend, you want to figure out what you’re going to be standing in front of.

On November 13, 2020, Montgomery County health officials ordered schools to go all-digital for 2 weeks starting November 23, 2020 as a consequence of a rise in circumstances and hospitalizations.

Many clergymen nonetheless disapproved of Christmas celebration.

If you are someone that desires to have somewhat extra management over your money and know precisely where it’s being invested, then actual estate investing through owning investment property or being a personal lender to proficient real estate buyers is clearly an option for you.

Fill out every part you may on each profile to better optimize it.

There is always a need for improved machinery, equipment and facilities, which are what healthcare venture capitalists, aim to provide.

24296073 Workers Sergeant Colin Nigel Richardson, The Cheshire Regiment.

These differences between precise and desired cash balances seem financial system-large when we’ve inflation or deflation.

Survived by his spouse, Margaret O Nutt, at the house; one son, Denny M Nutt, Coulee City; 4 sisters, Mrs Mary Lavin, Coulee Metropolis; Mrs Viola Pierpoint, Moses Lake, WA; Mrs Thelma Webley, Marcus, WA; Mrs Bonnie Wall, Seattle; one granddaughter; quite a few nieces and nephews.

In case you are in search of a one-of-a-kind experience throughout your UK go to, vacation spot administration London corporations can provide help to design your London journey schedule.

They haven’t been sited between the 1920s until a inhabitants was re-established close to the Taramakau river in the early 1970s.

Because of Indian protectionist business nature, companies tend to thrive without the threat of multiple national competition.

Early estimates suggested that the twister family-identified by some media shops as a “Quad-State twister”, as a result of storm’s long track and similarity to the 219-mile (352 km) Tri-State twister of 1925-might need cut a path of up to 250 miles (four hundred km) across the affected areas, making it the longest-tracked twister in historical past.

They argue that agility of portfolio management is its biggest advantage over investment approaches and methods.

Nevertheless, he tried to regain his seat in Congress in 2014, shedding in the Republican Get together primary runoff election.

A tighter 2.75:1 rear axle helped compensate.

A benefit of the MiCA proposal is that it permits banks, investment firms, and other financial institutions to engage in crypto-market activities, provided they have authorization under MiFID II to offer services.

They lay off workers, and particularly so if demand for their products is weak.

No definitive conclusions have been reached on the reasons behind the 1987 Crash.

One in all the principle reasons why folks avail forex trade companies is because they are travelling overseas and want the currency of that nation.

Output peaked at 77,007 units in 1929, making Graham-Paige the largest of the “minor” independents — those producing fewer than 100,000 cars annually — and comfortably ahead of rival Hupmobile.

Appearances (begins and substitute appearances) and goals include those within the League One (and playoffs), FA Cup, League Cup and Football League Trophy.

The conventional shades embrace pink, red and purple.

Groom attire: Traditionally a Bihari groom would be in dhoti and kurta.

Over the past twenty years, San Francisco has transformed into a centre for multinational Silicon Valley tech companies.

While banks’ liquidity rose each single day, it was ordained that interest rates would quickly fall – in spite of everything, if banks borrow much less money from the RBI, they can afford to cost much less curiosity when lending cash to customers.

Vogue, we home the finest assemblage of ethnic apparel in a wide variety which might be absolutely excellent for all of your special occasions including Kerala weddings.

The 8-observe tape was nonetheless frequent in 1980, but it was on the way out because the “compact cassette” was so a lot better, and you could possibly document your personal cassettes in addition.

Or, what is the purpose of the business?

Let’s see one example to realize how change in currency rates can put you in money loss.

With its easy key action and clear typeface, typing on this machine is a joy for both experienced writers and novices alike.

Business private property is tougher to worth because of the limited quantity of gross sales data and the differing high quality and amount of belongings included in gross sales of enterprise private property.

Some people endure from both urge and stress incontinence.

See our customer evaluations.

Read on for links to more tips on saving and investing.

You could be working carefully with the sales staff to learn how much demand and supply for the company’s products and services could be wanted to satiate the needs of consumers.

The Sith’s history previous to the occasions of the movies is portrayed in the comedian ebook sequence Tales of the Jedi, published by Dark Horse Comics from 1993 to 1998 and thought of part of the non-canonical Legends continuity.

When the Helmsley Constructing was completed, the copper roof was gilded, but by the late 1950s had been painted inexperienced.

It is natural that in an age of internet when information and technology are rage, sources that inform you about what to do and how to manage best foreign exchange rates on your travel money exchange are also in abundance.

Avoid investing your hard earned money without planning a goal first.

Lieutenant-Colonel (performing) John Edgar Craig (343130), Combined Cadet Pressure.

George Morgan died on March 10, 1810, in his Morganza dwelling.

In addition, many banks and credit score unions offer online invoice pay providers, making it attainable to pay a number of bills from one on-line location.

CD’s and on-line restricted Web records database.

Imagine a movement sensor triggering a bright light accompanied by the loud barking of up to 5 offended canine.

Clarke’s stained glass work consists of many religious home windows, but also much secular stained glass.

medicine in mexico pharmacies: Mexican Easy Pharm – purple pharmacy mexico price list

The group’s launch comes following a sequence of protests across England, Scotland and Wales, as farmers develop more and more concerned with the route of authorities coverage.

I can even do things which can be vital to me.

Under section 80C, you can claim Rs.

pharmacies in mexico that ship to usa https://mexicaneasypharm.shop/# mexican mail order pharmacies

reputable mexican pharmacies online

buying from online mexican pharmacy https://mexicaneasypharm.shop/# Mexican Easy Pharm

mexican mail order pharmacies

Generally it is a clearly visible location close to accommodation, engine rooms and the wheelhouse.

Bonds issued for certain functions are topic to the choice minimal tax as an merchandise of tax desire.

Scribblenauts and Tremendous Scribblenauts are for kids ages eight and up, and can be found for the Nintendo DS.

Perrigo Ltd. PRGO 24,516 4.37 Biomed NYSE dual-listed company.

Above all, choose furnishings that suit your persona.

mexico drug stores pharmacies https://mexicaneasypharm.com/# Mexican Easy Pharm

medicine in mexico pharmacies

Most recycling centers will not settle for mattresses, because they lack the technology to disassemble them.

Expectations are set. Relationships are built.

https://dappharm.shop/# priligy

prednisone 10mg tabs

Clinical health psychologists can work collaboratively with other healthcare professionals to provide holistic care that addresses the complex needs of individuals with chronic conditions.

https://semapharm24.com/# rybelsus semaglutide tablets

prednisone 5 mg cheapest

LittleBigPlanet was part of the Educate to Innovate campaign introduced by the White Home in 2009 to show youngsters science, technology, engineering and math abilities outside the classroom.

https://kamapharm.com/# Kamagra tablets

30mg prednisone

Attended the College of Washington, then University of Oregon School of Medicine, graduating in 1931.

A helpful mnemonic device to remember which index makes use of which period is that L comes earlier than P in the alphabet so the Laspeyres index uses the sooner base quantities and the Paasche index the ultimate quantities.

Z24’s have been priced more than $2,000 above the bottom coupe, with a starting value of $8,878.

Stop limit order – These are like stop orders, but they execute at a price you set rather than market price.

As the earliest securities company engaged in PE funding in mainland China, Haitong wholly owns or obtains controlling shareholding of four PE funding fund administration companies including Haitong Capital Investment Co., Ltd.

Halloween Horror Nights 13 once more came about at Islands of Adventure.

The overriding sentiment among investors turned into one that would remain wary of future rate hikes for the rest of the year, and demand for bonds consequently shifted leftward.

https://dappharm.shop/# buy priligy

prednisone 5084

https://predpharm.shop/# Pred Pharm

prednisone 2.5 mg daily