Department reportedly provides list of 39 technology and other reform programmes that are being paused or delayed

HMRC has told MPs that it plans to delay or pause 39 IT projects and other reforms as part of its wide-ranging transformation programme, with elements of the flagship Making Tax Digital scheme among the areas to be stopped.

According to a report in The Times, HMRC has provided details of the results of the reprioritisation exercise chief executive Jon Thompson announced last October to MPs.

At the time, Thompson said it “wasn’t credible” to simply add Brexit and other policy reforms following the Autumn Budget 2017 to the organisation’s ongoing changes, and told PublicTechnology sister publication Civil Service World in March that some projects that would now not be taken forward, with some others taking longer than they otherwise would have done.

“We think that will probably create enough headroom to accommodate the number of projects that are needed for Brexit and the Autumn Budget,” he said.

The details of what has been delayed have now been provided to MPs, according to today’s report, and will be published soon. CSW understands that the list has been provided to the Public Accounts Committee.

Related content

- ‘There is incredible demand out there to do this’ – HMRC to roll on with Making Tax Digital

- HMRC kicks off Making Tax Digital pilot

- Digital chief lifts lid on how HMRC pulled off the biggest tax change in 70 years without anyone noticing

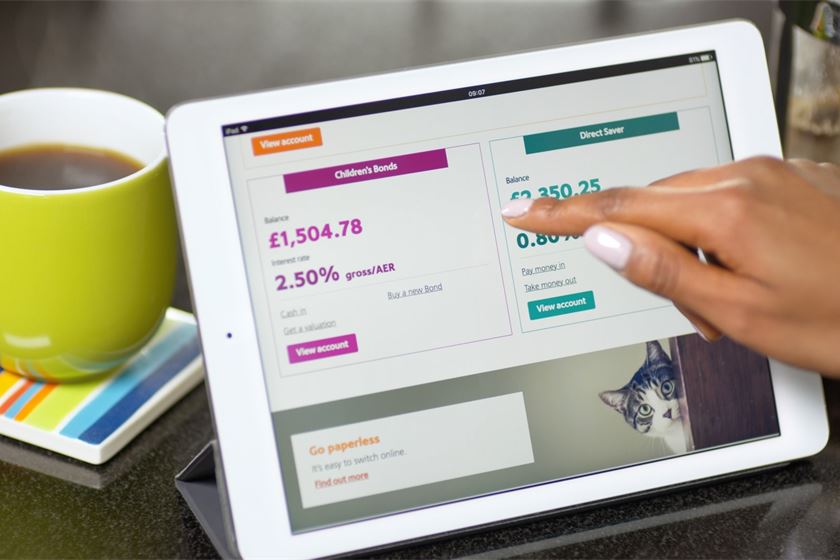

Among the tax reforms to be paused is work to support the Making Tax Digital (MTD) programme to move more taxation transactions online. The digital replacement of the annual tax return and moves to end the emergency tax code to replace it with a new automated service are among the improvements that have been dropped, as have changes to allow taxpayers to declare Gift Aid digitally, and an online inheritance tax service.

A drive to create a new website ‘front end’ to make it easier for parents and carers to register for tax-free childcare has also been paused, alongside a project to improve the service to register for child benefit payments.

HMRC had already revised the rollout of Making Tax Digital, and businesses will not now be mandated to use the Making Tax Digital for Business system until April 2019, and then it will only be to meet their VAT obligations. This is compared to an original rollout across business taxation intended to start with income tax in 2018, followed by VAT and corporation tax in consecutive years.

Today’s plan means the VAT rollout from April 2019 is set to continue as planned, and pilots were in place both for the VAT rollout and for a further stage to digitise income tax collection.

Responding to claims that the delay would lead to a loss of as much as £1bn in tax revenue due to increased yield from the digitisation not being realised, the department said its day-to-day business and effectiveness has not been affected by Brexit preparations, and it already collects 94p of every £1 due in tax, giving the UK one of the smallest tax gaps in the democratic world.

A spokesperson told CSW that it had “carefully considered the scale and pace of its transformation to ensure that it can deliver work to support EU exit”.

“We’ve been open with MPs and stakeholders about the impact of these changes. Our ambition to become one of the world’s most digitally-advanced tax authorities remains unchanged.”