Joanna Rowland will oversee planned expansion of programme across VAT, income tax and corporation tax

Credit: eFile989/CC BY-SA 2.0

HM Revenue and Customs has appointed its director general for transformation Joanna Rowland to lead the Making Tax Digital programme.

The £1bn scheme aims to digitise large parts of the UK’s tax system. Work began in April 2016 and is scheduled to continue for up another five years.

Rowland, who has been with been with HMRC for nearly five years, will spend about a quarter of her time working on MTD between now and the programme’s scheduled closure date of 31 March 2025.

In assuming the roles of responsible owner and senior business sponsor, she takes over from the previously named project leader Ruth Stanier, the department’s director general for customer strategy and tax design.

The appointment was announced in a newly published letter jointly sent to Rowland last month by Jim Harra and Nick Smallwood, the respective chief executives of HMRC and the Infrastructure and Projects Authority.

Related content

- HMRC seeks £125k leader for Making Tax Digital programme

- MPs urge HMRC to examine whether Making Tax Digital is ‘reasonable and affordable’ for taxpayers before proceeding with rollout

- HMRC and Home Office the big winners as spending review commits £600m to ‘fix outdated government IT’

“As SRO you have personal responsibility for delivery of the Making Tax Digital Programme and will be held accountable for the delivery of its objectives and policy intent; for securing and protecting its vision, for ensuring that it is governed responsibly, reported honestly, escalated appropriately; for influencing constructively the context, culture and operating environment of the project and for ensuring a post-implementation review is undertaken, where applicable,” they said.

“In addition to your internal accountabilities, SROs are personally accountable to parliamentary select committees. You will be expected to account for and explain the actions you have taken to deliver the Making Tax Digital Programme, or specific phases or milestones within them. In your case this means that from the date of signature of this letter [17 March] you will be held personally accountable and could be called by select committees in respect of the delivery of your Making Tax Digital Programme.”

As well as holding the accountability of the SRO position, Rowlands role as senior business sponsor will require here to “own and champion the business changes being delivered by the programme, providing effective business leadership and direction throughout the lifecycle of change”, the letter said.

Taxing work

The document also revealed that delivering the current planned scope of the project will cost a cumulative £787.8m. An extra £303.3m has been earmarked to support potential further expansion up to March 2026 – including an intention to extend the programme across the corporation tax system. This adds up to total spending of £1.09bn throughout the programme’s lifespan.

The scheme’s budget for the 2020/21 year was £105m, with the appointment letter indicating that HMRC was seeking a further £12.4m to support work in the year’s closing quarter.

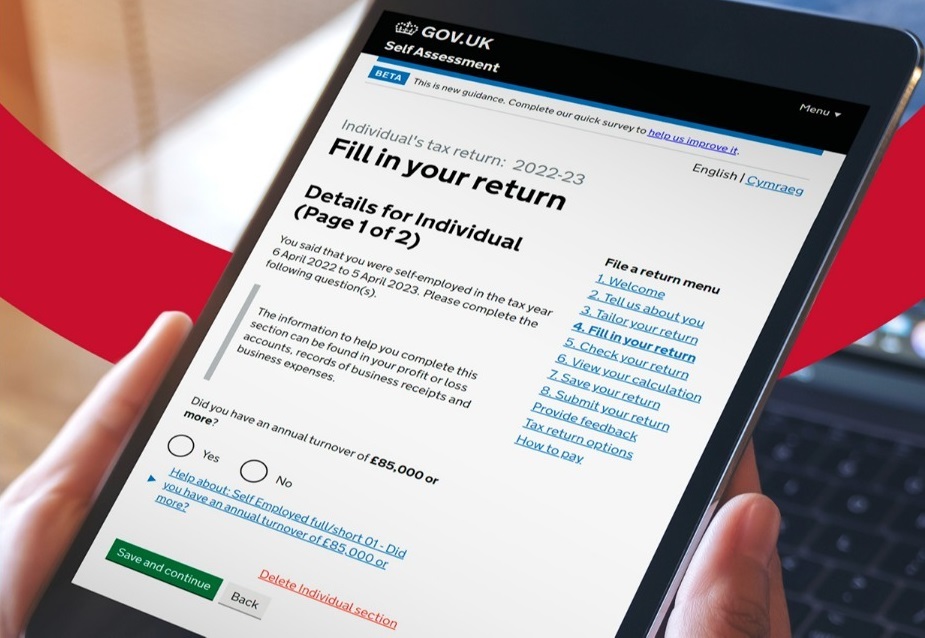

Since April 2019, businesses with annual revenue in excess of £85,000 have been required to file their quarterly VAT returns via the digital system.

From April next year, all businesses will need to do so, regardless of size. The following year MTD will be further expanded to cover income tax for individuals that make in excess of £10,000 a year from freelance work or property income.

Thereafter, HMRC’s ambition is to extend the digitisation scheme into corporation tax, although plans for this stage have not yet been formalised.

“The policy intent supported by this project is: to move the UK to a more modern and digital tax system for businesses, and by doing so to support business productivity and reduce errors made by businesses and landlords in self-assessing their tax liabilities,” the letter said. “In the first instance, this relates to VAT and ITSA (income tax self-assessment for the self-employed, partnerships and landlords, with a view to then implementing for corporation tax beyond the current business plan period.”

It added: “Making Tax Digital) is a key part of the government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs so that it is more effective and efficient.”

Rowland, who has been in her current role since November, leads HMRC’s newly created Transformation Business Group, as well as serving as head of the department’s programme and project management professions. Before assuming her new post, she spent several months heading up the tax agency’s coronavirus-response work, including the implementation of the furlough scheme. During her time at HMRC, she has held senior positions related to the organisation’s Brexit work, as well as previously spending a year on the Making Tax Digital programme.

She has also worked for the then Department of Culture, Media and Sport and the Ministry of Justice and, prior to joining government, worked in policing.