Department to stop automatically sending out hard-copy forms to those who used them in the previous year

Credit: GDS/CC BY 2.0

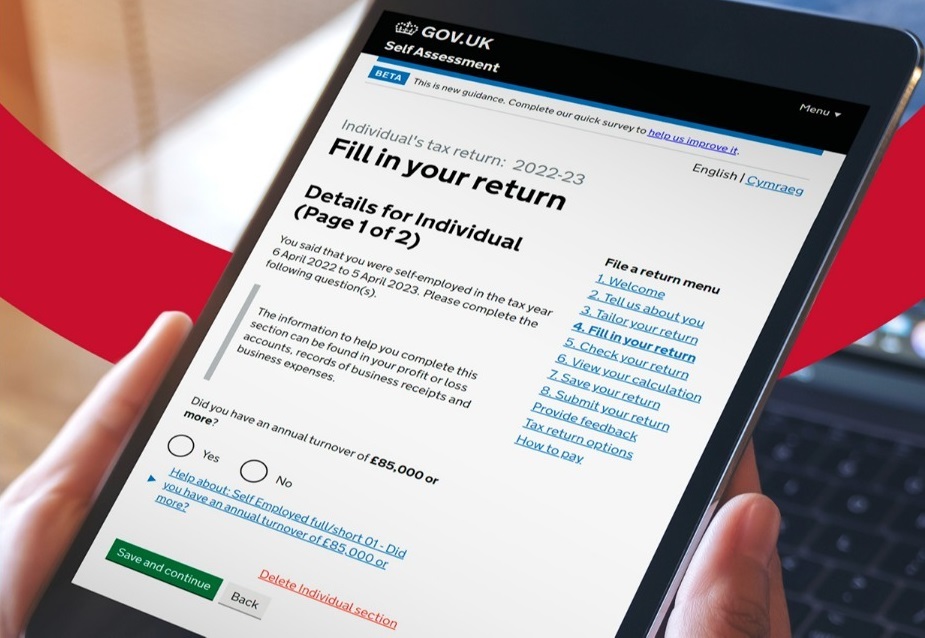

In a bid to encourage paper users to adopt digital platforms, HM Revenue and Customs will no longer automatically send out physical copies of tax-return forms.

Currently, 94% of all returns are filed online.

But, as a matter of course, the tax agency last year sent out 500,000 blank paper forms to the remaining 6% of users that had filed their return on paper the prior year. From next month, HMRC will only send these people a short notice reminding them to file their return.

The hope is that many of these will do so digitally, although paper forms will still be available for download, or can be sent by HMRC on request.

The department estimates that between 1% and 3% of taxpayers will be unable to file digitally for the incoming tax year because of “the nature of their return or their personal circumstances”.

Related content

- HMRC turns to real-time data in tax-avoidance clampdown

- HMRC chief salutes digital progress but targets reform of pay and processes

- Stats watchdog to probe HMRC’s £7bn tax data gaffe

“Where we can identify them in advance, we will provide them with a paper return in April 2020,” it said.

The short notices sent out to the remainder of paper users will also outline department’s preference to communicate with users solely through digital means in the future.

If and when these users next visit their online Personal Tax Account, they will be asked if they consent to the organisation communicating with them “digitally by default” for all future notices and correspondence.

Angela MacDonald, HMRC’s director general for customer services, said: “We are working hard to stop the use of unnecessary resources which have an environmental impact; that’s why we’re reducing the use of paper as much as possible. Digitisation remains an HMRC priority, but we’re still committed to giving taxpayers the ability to choose what’s best for them, so those who want to file a paper return can still do so.”

The cessation of automatic provision of hard-copy tax returns is one of a number of measures being taken by HMRC to try and eliminate paper use.

Annual PAYE tax summaries – which were last year posted out to 22 million people – are now to be moved online.

From April, the department will also no longer send employers across the UK a cumulative total of “more than three million blank P45s and 11 million P60s”.